MFEC Streamlines Cloud Finances with Aquila Clouds FinOps

MFEC Public Company Limited is a leading cloud services provider in Thailand. They help enterprises manage and optimize their cloud environments across multiple platforms while ensuring efficiency and compliance.

01 Problem

- Multi-cloud Complexity: MFEC needed to manage cloud costs across AWS, Azure, and GCP.

- Compartmentalization: Spending needed to be tracked by organizational units, projects, and workloads.

- Visibility Gaps: Lack of granular cost and performance insights for decision-makers.

- Budget Control: Needed proactive forecasting tools to prevent overspending.

- Manual Processes: Inefficient, time-consuming manual workflows for optimization.

02 Solution

Aquila Clouds’ FinOps platform and its Financial Domains concept empowered MFEC to address these challenges with:

- Compartmentalization: Cloud expenditures were organized into cost centers aligned with organizational units, projects, and workloads.

- Access Control: Role-based permissions ensured data visibility and management capabilities were tailored to specific stakeholders.

- Visibility and Reporting: Tailored cost summaries and details were provided for both executive decision-makers and IT teams.

- Forecasting and Budget Management: AI-powered tools provided accurate predictions of cost trends and budget consumption.

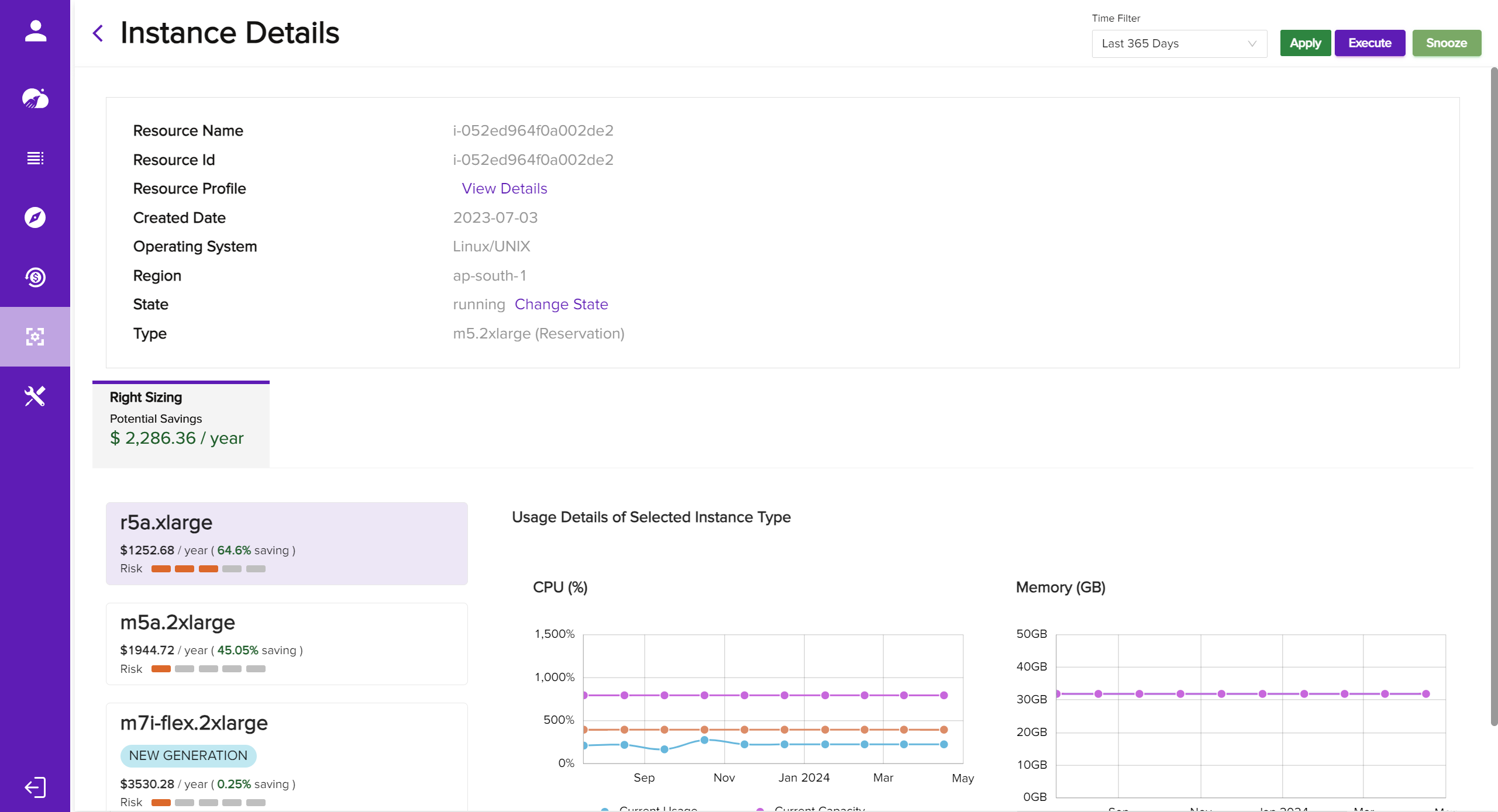

- Cost and Performance Optimization: Aquila Clouds identified optimization opportunities to reduce costs and improve the efficiency of cloud resources.

03 Results

MFEC experienced significant gains after implementing the Aquila Clouds FinOps Platform:

- OPEX Reduction: Achieved up to 20-20% savings in operational expenses due to streamlined processes.

- Operational Efficiency: Automation reduced manual FinOps efforts by 50-60%, allowing teams to manage 10x more cloud environments.

- Cloud Cost Savings: Customers achieved typical cloud cost reductions in the range of 25-30%.

- Decision-Making: Real-time data and forecasting reduced cloud-related decision times by 10-15%.

- Compliance: Automated budget controls and policy implementation enhanced adherence to company standards, reducing risk by an estimated 20-25%.

- Increased Customer Satisfaction: Enhanced service delivery, transparency, and cost control led to happier customers.

- Workflow Standardization: Streamlined processes for cost and performance optimization ensured consistency.

- Executive Dashboards: Automated generation of easy-to-consume dashboards for customer leadership.